HOW DOES

The forex market work

Unlike most financial markets, the forex market is different, within the foreign exchange market, there is no physically specific place to trade. The entire foreign exchange market operates through the use of electronic banking network infrastructure, various financial institutions and the electronic transactions between individuals. Moving accord to the time difference, foreign exchange transactions per day originate from Sydney and then move to Tokyo, London and New York.

How to start

STARTING POINT

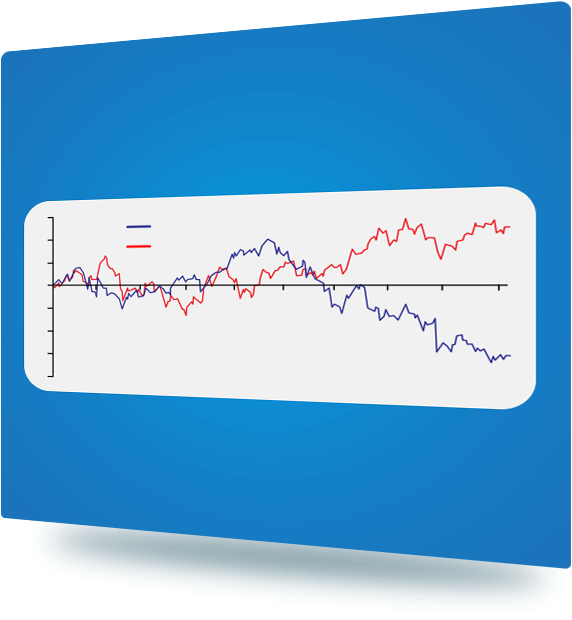

Currency quotes are usually composed of five decimal places, for example if the EUR / USD quotes are 1.24110 / 1.24111, the last number is the decimal point and the second last point is the pips. Most of the time, the movement of the markets will be monitored based on the pips movement. Therefore, the trader will monitor each pip movement (1 pip = 0.00010) changes in the currency pair they are trading. There are two ways a trader will go to make the market prediction which is technical analysis and fundamental analysis. Technical traders will make use of various analytical methods such as charts, trend lines, support / resistance levels, and mathematical models to identify opportunities while attempting to make trading decisions. Another type of trader tends to rely on fundamental analysis and various economic indicators towards the reaction of a specific currencies national economy and will incorporate the analysis of market drivers, such as GDP growth, inflation, interest rates and so on

Pricing in Forex Market exchange

The definition of foreign exchange

What makes forex so appealing

Changes in economic climate and policies generally only produce a short-term impact on the exchange, so when these mitigating factors eventually lead on to the stock and bond markets they adversely trend. While the foreign exchange market can provide to investors more choice and opportunities.

Our Features

Buying, selling, and spreads

The forex market sets the initial price or quote, And the other financial markets make the same as the purchase price included and selling prices. Suppose the dollar / yen trading price (bid / ask) is at a rate 117.33 / 117.36, if you were to believe that the dollar will weaken, you could press at the 117.33 price to sell the currency pair.

Open Live Account

Start trading on our fast execution and low latency platform now!